Compare Lustrum:ASKUL Corporation:2678

※The values of financial statements might be different from the actual ones. Please confirm the original. [instructions]

| Main Function |

Company Name |

Code |

Types of Industry |

Market Name | Fiscal Year End | Year of Listing |

|---|---|---|---|---|---|---|

|

|

ASKUL Corporation |

2678 | Retail | 東証プライム | May 1, 2000 | 2000. |

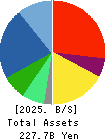

ASKUL Corporation Balance Sheet(B/S)

![[Show - Hide]](/img/change.gif) U-Chart:Balance Sheet (B/S)

U-Chart:Balance Sheet (B/S) Color coding indicates a color coding of Balance Sheet (B/S). Total area of pie chart also indicates total assets in Balance Sheet (B/S). The sequence of U-Charts (pie charts) is equivalent to the sequence of Balance Sheet (B/S).

Color coding indicates a color coding of Balance Sheet (B/S). Total area of pie chart also indicates total assets in Balance Sheet (B/S). The sequence of U-Charts (pie charts) is equivalent to the sequence of Balance Sheet (B/S).

U-Charts are set in the order of Balance Sheet (B/S) from nearest to oldest in a left-to-right fashion.

You can change the size of U-Chart by clicking ![[拡大]](/img/plus.gif)

![[縮小]](/img/minus.gif) .

.

You can switch display or no display by clicking ![[表示非表示]](/img/change.gif) .

.

【Left:Outgoing Money】 【Right:Incoming Money】

![[Show - Hide]](/img/change.gif) Balance Sheet (B/S)

Balance Sheet (B/S) [Outlier] Shareholder's equity is minus(=asset deficiency). Shareholder's equity is in the left half circle of U-Chart.

[Outlier] Shareholder's equity is minus(=asset deficiency). Shareholder's equity is in the left half circle of U-Chart.  ※Unit:Millions of Yen

※Unit:Millions of Yen

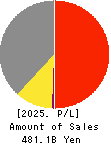

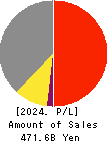

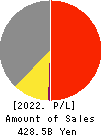

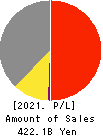

ASKUL Corporation Profit and Loss Account(P/L)

![[表示非表示]](/img/change.gif) U-Chart:Profit and Loss Account (P/L)

U-Chart:Profit and Loss Account (P/L) Color coding indicates a color coding of Profit and Loss Account (P/L). Total area of pie chart also indicates total assets in Profit and Loss Account (P/L). The sequence of U-Charts (pie charts) is equivalent to the sequence of Profit and Loss Account (P/L).

Color coding indicates a color coding of Profit and Loss Account (P/L). Total area of pie chart also indicates total assets in Profit and Loss Account (P/L). The sequence of U-Charts (pie charts) is equivalent to the sequence of Profit and Loss Account (P/L).

U-Charts are set in the order of Profit and Loss Account (P/L) from nearest to oldest in a left-to-right fashion.

You can change the size of U-Chart by clicking ![[拡大]](/img/plus.gif)

![[縮小]](/img/minus.gif) .

.

You can switch display or no display by clicking ![[表示非表示]](/img/change.gif) .

.

【Left:Outgoing Money】 【Right:Incoming Money】

![[Show - Hide]](/img/change.gif) Profit and Loss Account (P/L)

Profit and Loss Account (P/L) [Outlier] Net income is minus(=net deficit for the period). Net deficit for the period is in the right half circle of U-Chart.

[Outlier] Net income is minus(=net deficit for the period). Net deficit for the period is in the right half circle of U-Chart.  ※Unit:Millions of Yen

※Unit:Millions of Yen

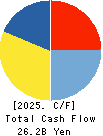

ASKUL Corporation Cash Flow Statement(C/F)

![[表示非表示]](/img/change.gif) U-Chart:Cash Flow Statement (C/F)

U-Chart:Cash Flow Statement (C/F) Color coding indicates a color coding of Cash Flow Statement (C/F). Total area of pie chart also indicates total assets in Cash Flow Statement (C/F). The sequence of U-Charts (pie charts) is equivalent to the sequence of Cash Flow Statement (C/F).

Color coding indicates a color coding of Cash Flow Statement (C/F). Total area of pie chart also indicates total assets in Cash Flow Statement (C/F). The sequence of U-Charts (pie charts) is equivalent to the sequence of Cash Flow Statement (C/F).

U-Charts are set in the order of Cash Flow Statement (C/F) from nearest to oldest in a left-to-right fashion.

You can change the size of U-Chart by clicking ![[拡大]](/img/plus.gif)

![[縮小]](/img/minus.gif) .

.

You can switch display or no display by clicking ![[表示非表示]](/img/change.gif) .

.

【Left:Outgoing Money】 【Right:Incoming Money】